- Welcome to the Givealittle Help Centre

- Charity Hub

- Boosting generosity with TaxGift

Boosting generosity with TaxGift

Registrations suspended

(Updated 10 Oct 2022)

Unfortunately, due to restrictions recently put in place by the IRD, our partner TaxGift have paused new registrations for the TaxGift service.

Donors who completed their TaxGift registration by July 6 will have their Tax Credit processed via TaxGift and passed back to the intended charity.

However, TaxGift are currently unable to process Tax Credit applications for anyone who has not yet registered, or who registered after July 6.

We are in the process of figuring out the best way forward for affected donors and charities and will be in touch soon. We apologise for any inconvenience.

If you have any questions, please contact us.

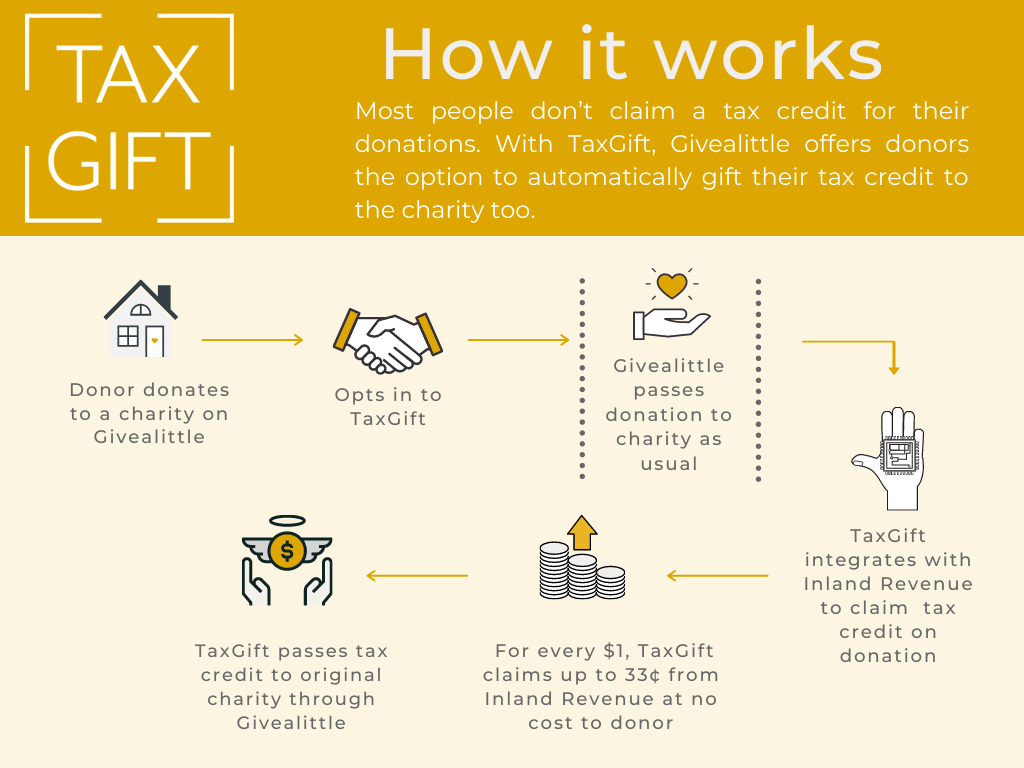

Givealittle has partnered with TaxGift to harness the power of donation tax credits and give donors the option to donate their available tax credit to you as the initial charity recipient. Approximately $250m of charitable giving tax credits go unclaimed in Aotearoa every year and great things that can be achieved by unlocking the value of those tax credits to do good.

TaxGift is a simple, secure and fully compliant service. Donors are given the opportunity to tick a box to re-gift the available tax credit to the recipient charity, as an additional cash gift. The first time a donor chooses this option they will be followed up with to supply their IRD number and approve TaxGift as a tax agent with authority to process their tax credits for the purpose of re-gifting this to you. Once they have registered with TaxGift a donor will only need to tick the box on a donation for the tax credit to be regifted.

If your organisation is registered as a charitable entity with the IRD, you will be marked as eligible for tax-credit receipts in Givealittle, and donors will see the option to use TaxGift. It is recommended to encourage your donors to opt-in to TaxGift but you don’t need to do anything to claim your donations. Givealittle will keep you posted on the amount of eligible donations and will advise when the annual tax rebate donations come through.

From an initial donation of $5 or more, donors can opt-in to amplify their impact by a minimum of 33.33% of their original donation.

Example 1:

Original donation of $10.00

The available tax credit is 33.33% or up to $3.33. If the donor opts-in to TaxGift, this is re-gifted to the original charity beneficiary after the donor’s tax position for the year is finalised.

The total additional gifted via Givealittle, using TaxGift, is $3.33 at no cost to the donor. $3.33 being less than the $5 minimum threshold to qualify for a tax rebate, the TaxGift benefit ends.

Donations processed through Givealittle via TaxGift attract a combined fee of 12.35%+GST. The fee is off-set against the amount passed to the charity, which receives an additional $2.86 (after fees) with little to no effort. The charity will also be able to claim back the GST component.

Example 2:

Original donation of $100.00

The available tax credit is $33.33. Once the donor opts-in to TaxGift this is re-gifted to the original charity beneficiary after the donor’s tax position for the year is finalised.

Once the $33.33 is re-gifted and the tax position for the ensuing period is complete, this results in a further tax credit of $11.11 that is donated as an additional cash gift. Henceforth, another tax credit of $3.70 is donated as a cash gift after the following tax year.

$3.70 being below the $5 minimum threshold to be eligible for a charitable tax refund, the TaxGift benefit ends.

Over three years, from an initial donation of $100, the impact for a donor opting in to TaxGift is up to $48.14, more than 48% of the initial donation - at no cost to the donor.

Donations processed through Givealittle via TaxGift attract a combined fee of 12.35%+GST. The fee is off-set against the amount passed to the charity, which receives an additional $41.30 (after fees) with little to no effort. The charity will also be able to claim back the GST component.

When does the charity receive the funds?

TaxGift batches donation rebate claims for processing at the end of a tax year and receives the eligible rebates once tax returns are processed. Donations are then provided to Givealittle to allocate to beneficiary charities. In some cases it may take one to two years for an original donation tax credit to be processed by the IRD. In subsequent years, donation tax credits are typically processed annually.

Who is TaxGift?

TaxGift is a Kiwi organisation born out of a desire to help those in the charity sector maximise their impact through fundraising, by helping generous New Zealanders, maximise their social impact through charitable giving. TaxGift is a member of the Fundraising Institute of New Zealand (FINZ) and is bound by its code of ethics and code of conduct. Please see the TaxGift FAQs on their website for further information.

Who pays the processing costs?

Re-gifting a tax credit doesn’t cost the donor anything, but it does mean the donor will forego their tax benefit. Due to the volume and nature of the work required to administer, track and apply funds on behalf of many donors, a combined TaxGift/Givealittle fee of 14.2% (12.35%+GST) is charged on the total of the tax rebates received and this is charged to the charity beneficiaries, who can claim back the GST component.